I work as a freelancer and have clients all around the English speaking world which is great but comes with the problem of getting paid. I mainly rely on PayPal as most people have a PayPal account, however it always hurts a little when I see the fees and exchange rates after each invoice is paid. Because of this I have looked at new ways to try and get more of the money I earn to actually hit my bank account which is how I found Transferwise.

Dealing with multiple currencies always adds the annoyance of transfer fees when dealing with wire transfers and I am always looking for ways to save money in this area.

What is Transferwise?

TransferWise is an online service for sending and receiving money across different currencies. It allows you to have virtual’ bank accounts in multiple countries that people can pay into like they would with anyone in their country, they don’t need a Transferwise account.

This is how I came across this service as I have clients all around the world and get paid in multiple currencies which when get exchanged to my local currency incurs fees. This isn’t the case with Transferwise as they convert the currency at the standard rates you’ll see in Google so they are not making a cut like many other services do e.g PayPal.

How Transferwise Works

TransferWise works by having bank accounts in multiple countries, when someone in another country sends money to you in reality their money goes to the Transferwise account in that country and then you get paid by the Transferwise account in your country. So no money actually goes across borders hence no exchange fees.

Here is a video explaining their Border-less Account:

Is Transferwise Safe?

Naturally with any situation where you are trusting your money with a company you want to know it is in safe hands especially when that company is purely web based. The above idea of sending money to a company and them promising on sending it to you from a different account can cause a little anxiety but Transferwise does not actually hold your money themselves they are held in reputable banks in the countries they operate so you have the same protection as if you were living in that country yourself.

Transferwise Rates & Fees

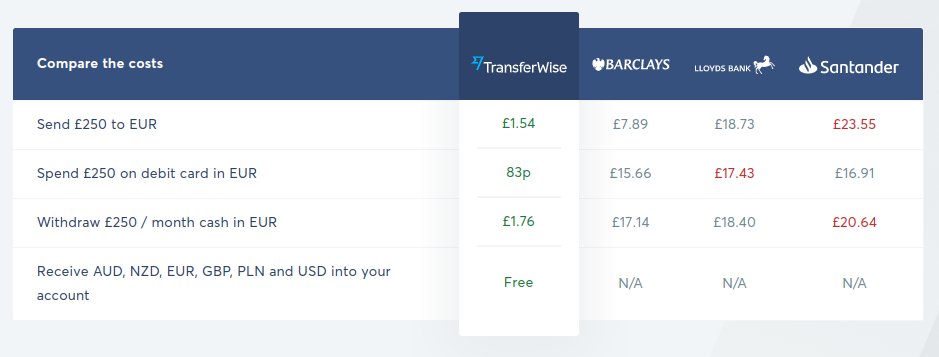

Unlike most banks/money exchange services Transferwise are actually totally transparent with their fees. They charge a percent of the transfer amount, and a flat fee for certain currency exchanges. The fees and percent are calculated on the currencies exchanging.

Here is an example as shown on their website.

How does TransferWise charge such low fees?

Because they don’t actually transfer the funds across borders there are far fewer fees for them which means far fewer for you!

Is Transferwise Cheapest Way To Transfer Money Between Countries?

Yes probably, of all the options I have seen it wins in straight head to head comparisons.

Advantages

- – Transparent with fixed fees

- – No monthly/subscription charges

- – Safe and credible

- – Easy to use interface

- – Fast transfers

- – Payer doesn’t need a Transferwise account

Disadvantages

- – No discounts for larger transfers

- – Not all countries/countries covered (yet)

“Transferwise has low fees, a transparent pricing structure and is stripping all the complexity out of international money transfers.”

Jordan Bishop

Forbes

Summary

Overall I am very happy with the service and would rate it 4.8/5.

I am shifting all my clients to pay me via my Transferwise accounts instead of my PayPal account, sometimes they are reluctant about this. The main concern seems to be from US businesses who think paying into a US account means they need a W-9 Form from you, this is not the case. Once you explain that it isn’t necessary as the W-9 forms are for US residents only they should be fine with it. Just give the tax ID you use in your home country on your invoice and that will satisfy their accounting systems.

Shifting to TransferWise means my take home income has improved and when you are freelancing every dollar counts!